We are happy to help you select and sign up for the right plan.

For more information on Medicare insurance enrollment & plan options for Long Island, New York residents, contact our Medicare agents today.

Read more of our informative posts on Medicare insurance options below:

- NY Defensive Driving Course Discount Code

Online Defensive Driving Course Discount / NY Accident Prevention Workshops: 100% online! Login and logout as many times as you like – progress checkpoints allow you to always continue exactly where you left off. The cost of the course is usually $44.95 but with our promo code CRM15 the cost of the course is discounted by $15, making the cost to the student $29.95! Online defensive driving classes are an effective way to reduce auto insurance payments and remove points from your license. To register, go to: Course.EmpireSafetyCouncil.com Use code CRM15 at registration for $15 off. NEW YORK STATE &…

Online Defensive Driving Course Discount / NY Accident Prevention Workshops: 100% online! Login and logout as many times as you like – progress checkpoints allow you to always continue exactly where you left off. The cost of the course is usually $44.95 but with our promo code CRM15 the cost of the course is discounted by $15, making the cost to the student $29.95! Online defensive driving classes are an effective way to reduce auto insurance payments and remove points from your license. To register, go to: Course.EmpireSafetyCouncil.com Use code CRM15 at registration for $15 off. NEW YORK STATE &… - Apply for Medicare Part B

If you need to apply for Medicare Part B, contact us for a free consultation. The two downloads below are printable forms to enroll in Medicare Part B. These 2 documents need to be completed in order to enroll in Medicare Part B. Form #1: REQUEST FOR EMPLOYMENT INFORMATION WHAT IS THE PURPOSE OF THIS FORM? In order to apply for Medicare in a Special Enrollment Period, you must have or had group health plan coverage within the last 8 months through your or your spouse’s current employment. People with disabilities must have large group health plan coverage based on…

If you need to apply for Medicare Part B, contact us for a free consultation. The two downloads below are printable forms to enroll in Medicare Part B. These 2 documents need to be completed in order to enroll in Medicare Part B. Form #1: REQUEST FOR EMPLOYMENT INFORMATION WHAT IS THE PURPOSE OF THIS FORM? In order to apply for Medicare in a Special Enrollment Period, you must have or had group health plan coverage within the last 8 months through your or your spouse’s current employment. People with disabilities must have large group health plan coverage based on… - Applying for Medicare Parts A & B Online

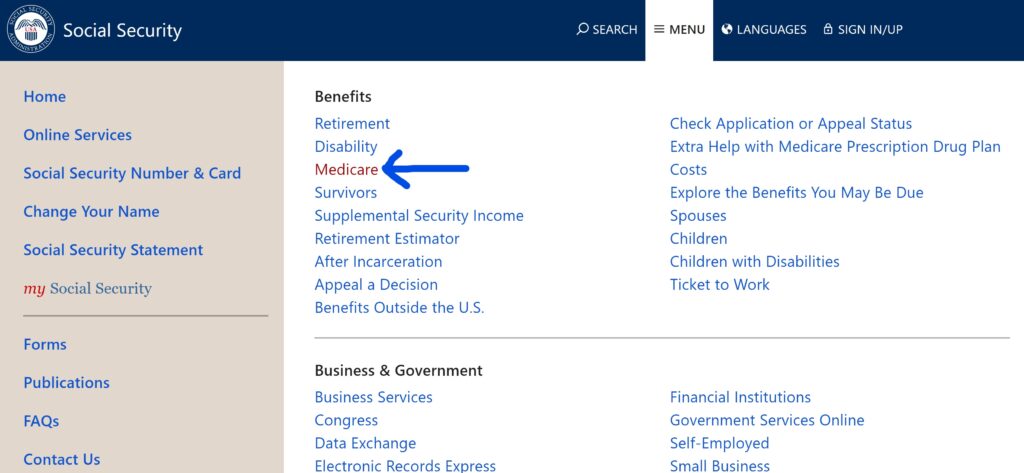

The link below is for new enrollment in applying for Medicare Parts A & B. https://www.ssa.gov People need to enroll in both Medicare Part A & B if they are not enrolled in Social Security. Beneficiaries enrolled in S.S. automatically enroll in Medicare Part A. You need BOTH parts of Medicare A & B if: you are turning 65 or you never enrolled in Part A when still working Here’s step by step directions & images to get where you need to go for applying for Medicare Parts A & B online: 1 – Go to ssa.gov 2 – Go…

The link below is for new enrollment in applying for Medicare Parts A & B. https://www.ssa.gov People need to enroll in both Medicare Part A & B if they are not enrolled in Social Security. Beneficiaries enrolled in S.S. automatically enroll in Medicare Part A. You need BOTH parts of Medicare A & B if: you are turning 65 or you never enrolled in Part A when still working Here’s step by step directions & images to get where you need to go for applying for Medicare Parts A & B online: 1 – Go to ssa.gov 2 – Go… - Humana Gold Plus Medicare Advantage Plan

The Humana Gold Plus Medicare Advantage plan has a wide range of coverage for Long Island seniors. Humana has contracted with Medicare to provide you with services that aren’t covered by Medicare Parts A & B. With Gold Plus HMO Plans, your out-of-pocket costs are reduced and more predictable than with the majority of other plans. You may enroll in a Humana Gold Plus Medicare Advantage Plan only during specific times of the year. Below is a summary of the Humana Gold Plus Medicare Advantage Plan: Office Visit for Primary Doctor $10 copay for each primary care doctor visit for…

The Humana Gold Plus Medicare Advantage plan has a wide range of coverage for Long Island seniors. Humana has contracted with Medicare to provide you with services that aren’t covered by Medicare Parts A & B. With Gold Plus HMO Plans, your out-of-pocket costs are reduced and more predictable than with the majority of other plans. You may enroll in a Humana Gold Plus Medicare Advantage Plan only during specific times of the year. Below is a summary of the Humana Gold Plus Medicare Advantage Plan: Office Visit for Primary Doctor $10 copay for each primary care doctor visit for… - Humana Gold Plus (HMO)

Humana Gold Plus is a Medicare Advantage health maintenance organization (HMO) plan with a wide range of coverage for Long Island seniors. They offer all-in-one Medicare plans such as the Humana Gold Plus (HMO) plan, which includes: $0 Plan Premium with $50 Part B Premium Giveback HMO MAPD Plan with lean benefits. Humana HMO plans cover all the benefits of Original Medicare & more, including: Choice of a primary care physician from within the plan’s provider network Affordable monthly plan premiums; $0 premium on some plans in some areas Prescription drug coverage equal to or better than the standard requirement…

Humana Gold Plus is a Medicare Advantage health maintenance organization (HMO) plan with a wide range of coverage for Long Island seniors. They offer all-in-one Medicare plans such as the Humana Gold Plus (HMO) plan, which includes: $0 Plan Premium with $50 Part B Premium Giveback HMO MAPD Plan with lean benefits. Humana HMO plans cover all the benefits of Original Medicare & more, including: Choice of a primary care physician from within the plan’s provider network Affordable monthly plan premiums; $0 premium on some plans in some areas Prescription drug coverage equal to or better than the standard requirement… - Turning 65? Pick Medicare benefits with an agent you can trust

Medicare Supplement plans, Medicare Advantage plans, Part D plans, formularies, Medigap policies… These are just some health insurance choices facing Medicare-eligible individuals. This array of options is only complicated further by various coverage designs of individual insurers, each complete with individualized provider networks & drug formularies. We know this can seem overwhelming.. MedicareSolutionsLongIsland.com has a number of articles designed to help you understand the various plans that can be combined with traditional Medicare benefits.However, there is no substitute for personalized, concierge broker services. THAT’S EXACTLY WHAT’S AVAILABLE TO MEDICARE-ELIGIBLE INDIVIDUALS LIVING IN NEW YORK (631) 777-7373. If you want expert…

Medicare Supplement plans, Medicare Advantage plans, Part D plans, formularies, Medigap policies… These are just some health insurance choices facing Medicare-eligible individuals. This array of options is only complicated further by various coverage designs of individual insurers, each complete with individualized provider networks & drug formularies. We know this can seem overwhelming.. MedicareSolutionsLongIsland.com has a number of articles designed to help you understand the various plans that can be combined with traditional Medicare benefits.However, there is no substitute for personalized, concierge broker services. THAT’S EXACTLY WHAT’S AVAILABLE TO MEDICARE-ELIGIBLE INDIVIDUALS LIVING IN NEW YORK (631) 777-7373. If you want expert… - WEBINAR: Open Enrollment 2020

Open Enrollment 2020 and a look at the PPP Loan Forgiveness Report. Open Enrollment is a once-per-year opportunity to review the medical, dental, vision, and other insurance plans offered by your company and make any adjustments if needed. Medicare’s annual Open Enrollment Period is October 15 to December 7 to join, switch, or drop your health insurance plan. During this time each year, you can change coverage. Tune into this webinar as we dive into what you can expect during Open Enrollment this year. We’ll also provide a look at the new PPP Loan Forgiveness Report from PrestigePEO. Join our…

Open Enrollment 2020 and a look at the PPP Loan Forgiveness Report. Open Enrollment is a once-per-year opportunity to review the medical, dental, vision, and other insurance plans offered by your company and make any adjustments if needed. Medicare’s annual Open Enrollment Period is October 15 to December 7 to join, switch, or drop your health insurance plan. During this time each year, you can change coverage. Tune into this webinar as we dive into what you can expect during Open Enrollment this year. We’ll also provide a look at the new PPP Loan Forgiveness Report from PrestigePEO. Join our… - Preferred Provider Organizations (PPO)

Preferred Provider Organizations (PPO) are one type of Medicare Advantage plan that allows you to choose your own health care providers. Each PPO has a network of doctors, hospitals, and other health care providers called “preferred providers.” Members typically pay less if they use a preferred provider because the plan has already negotiated set rates with its preferred providers. However, you are not tied to the network and care from other health care providers is covered. Services usually cost more to the patient for out-of-network care. This flexibility is one of the reasons that PPO plans are often more expensive…

Preferred Provider Organizations (PPO) are one type of Medicare Advantage plan that allows you to choose your own health care providers. Each PPO has a network of doctors, hospitals, and other health care providers called “preferred providers.” Members typically pay less if they use a preferred provider because the plan has already negotiated set rates with its preferred providers. However, you are not tied to the network and care from other health care providers is covered. Services usually cost more to the patient for out-of-network care. This flexibility is one of the reasons that PPO plans are often more expensive… - Health Maintenance Organizations (HMOs)

Health Maintenance Organizations, otherwise known as HMOs, are one type of Medicare Advantage plan. HMOs are typically the most affordable type of plan available. HMO offers the lower premiums, co-pays and co-insurance than PPO plans. However, HMOs are less flexible than some other options. HMOs have a set network of hospitals, doctors, and other health care providers. The HMO has a set payment level for services with these providers. With an HMO, you must use providers in your network to be covered for services. There are exceptions to the in-network requirement for true emergencies. The HMO Model Under an HMO,…

Health Maintenance Organizations, otherwise known as HMOs, are one type of Medicare Advantage plan. HMOs are typically the most affordable type of plan available. HMO offers the lower premiums, co-pays and co-insurance than PPO plans. However, HMOs are less flexible than some other options. HMOs have a set network of hospitals, doctors, and other health care providers. The HMO has a set payment level for services with these providers. With an HMO, you must use providers in your network to be covered for services. There are exceptions to the in-network requirement for true emergencies. The HMO Model Under an HMO,… - Can individuals diagnosed with Multiple Sclerosis qualify for Medicare?

Individuals with Multiple Sclerosis qualify for Medicare in the same ways as any other individual. First, someone with MS can qualify for Medicare simply by turning 65 as an American citizen and receiving Social Security benefits. Younger persons with Multiple Sclerosis qualify for Medicare coverage before age 65 if: (1) Social Security determines that they are permanently disabled; and(2) they have received Social Security disability benefits for 24 months. Simply having a long-term illness or needing long term care does not preclude you from Medicare coverage. However, beneficiaries are sometimes denied Medicare coverage for services based on a chronic or…

Individuals with Multiple Sclerosis qualify for Medicare in the same ways as any other individual. First, someone with MS can qualify for Medicare simply by turning 65 as an American citizen and receiving Social Security benefits. Younger persons with Multiple Sclerosis qualify for Medicare coverage before age 65 if: (1) Social Security determines that they are permanently disabled; and(2) they have received Social Security disability benefits for 24 months. Simply having a long-term illness or needing long term care does not preclude you from Medicare coverage. However, beneficiaries are sometimes denied Medicare coverage for services based on a chronic or… - Medicare, Coronavirus Testing & Telehealth

Like many aspects of American life, the Coronavirus has caused significant changes to Medicare and Medicare benefits. Key among those are expanded access to telehealth services in order to allow beneficiaries to continue to access healthcare while sheltering in place, expanded access to Coronavirus testing, and the relaxation of some rules around cost sharing. Coronavirus Testing The Centers for Medicare and Medicaid Services (CMS) now permits Medicare and Medicaid beneficiaries to get tested for COVID-19 without a written order from a physician. This change will allow more individuals to be tested and help contain the spread of the virus. Under…

Like many aspects of American life, the Coronavirus has caused significant changes to Medicare and Medicare benefits. Key among those are expanded access to telehealth services in order to allow beneficiaries to continue to access healthcare while sheltering in place, expanded access to Coronavirus testing, and the relaxation of some rules around cost sharing. Coronavirus Testing The Centers for Medicare and Medicaid Services (CMS) now permits Medicare and Medicaid beneficiaries to get tested for COVID-19 without a written order from a physician. This change will allow more individuals to be tested and help contain the spread of the virus. Under… - Coronavirus & Prescription Medications

With the new coronavirus pandemic caused by COVID-19 dominating the news, people worldwide are stockpiling necessities. As some store shelves run bare of toilet paper and cleaning supplies, prescription medications may be far from mind in your preparations. However, public health experts are advising the most vulnerable people – including those who are 65 and older – to stock up on prescription medications so that they are prepared to shelter in place for an extended period. Indeed, with a standard quarantine period of fourteen (14) days, a good rule of thumb is to have a two weeks worth of necessary…

With the new coronavirus pandemic caused by COVID-19 dominating the news, people worldwide are stockpiling necessities. As some store shelves run bare of toilet paper and cleaning supplies, prescription medications may be far from mind in your preparations. However, public health experts are advising the most vulnerable people – including those who are 65 and older – to stock up on prescription medications so that they are prepared to shelter in place for an extended period. Indeed, with a standard quarantine period of fourteen (14) days, a good rule of thumb is to have a two weeks worth of necessary… - Online Defensive Driving Classes During Coronavirus Shut In

Online defensive driving classes – A great way to save money on your car insurance! With many New Yorkers staying home to help stop the spread of COVID-19, a lot of people are finding themselves with some free time on their hands. An excellent way to spend that free time while addressing the potential financial insecurity that may lie ahead is to take an online defensive driving course. Save 10% on your auto insurance for 3 years.Reduce up to 4 points from your driving record.Approved by the NYS Department of Motor Vehicles Defensive driving courses can be taken entirely online,…

Online defensive driving classes – A great way to save money on your car insurance! With many New Yorkers staying home to help stop the spread of COVID-19, a lot of people are finding themselves with some free time on their hands. An excellent way to spend that free time while addressing the potential financial insecurity that may lie ahead is to take an online defensive driving course. Save 10% on your auto insurance for 3 years.Reduce up to 4 points from your driving record.Approved by the NYS Department of Motor Vehicles Defensive driving courses can be taken entirely online,… - What Medicare Covers When It Comes to Coronavirus

Testing, telehealth and future vaccines for Coronavirus are included, CMS chief says. As the number of COVID-19 cases continues to climb in the U.S., Medicare is increasing access to testing and treatment for older adults, who health experts say are most at risk for severe illness caused by the coronavirus. In an AARP Coronavirus Information Tele-Town Hall event on March 10, Seema Verma, administrator of the Centers for Medicare and Medicaid Services (CMS), reiterated that Medicare beneficiaries will not be on the hook for out-of-pocket costs and copayments associated with coronavirus testing. Verma added that many Americans with private insurance…

Testing, telehealth and future vaccines for Coronavirus are included, CMS chief says. As the number of COVID-19 cases continues to climb in the U.S., Medicare is increasing access to testing and treatment for older adults, who health experts say are most at risk for severe illness caused by the coronavirus. In an AARP Coronavirus Information Tele-Town Hall event on March 10, Seema Verma, administrator of the Centers for Medicare and Medicaid Services (CMS), reiterated that Medicare beneficiaries will not be on the hook for out-of-pocket costs and copayments associated with coronavirus testing. Verma added that many Americans with private insurance… - Do you know your blood pressure numbers?

If you haven’t had your blood pressure checked lately, now’s the time. About 1 in 3 U.S. adults have high blood pressure — and you could be one of them. High blood pressure usually has no signs or symptoms, but it can lead to a higher risk of heart disease, stroke, and kidney failure. The only way to know if you have high blood pressure (or hypertension) is to have your blood pressure tested. Do you know your blood pressure numbers? Medicare covers blood pressure checks during your yearly “wellness” visit and “Welcome to Medicare” preventive visit at no cost…

If you haven’t had your blood pressure checked lately, now’s the time. About 1 in 3 U.S. adults have high blood pressure — and you could be one of them. High blood pressure usually has no signs or symptoms, but it can lead to a higher risk of heart disease, stroke, and kidney failure. The only way to know if you have high blood pressure (or hypertension) is to have your blood pressure tested. Do you know your blood pressure numbers? Medicare covers blood pressure checks during your yearly “wellness” visit and “Welcome to Medicare” preventive visit at no cost…