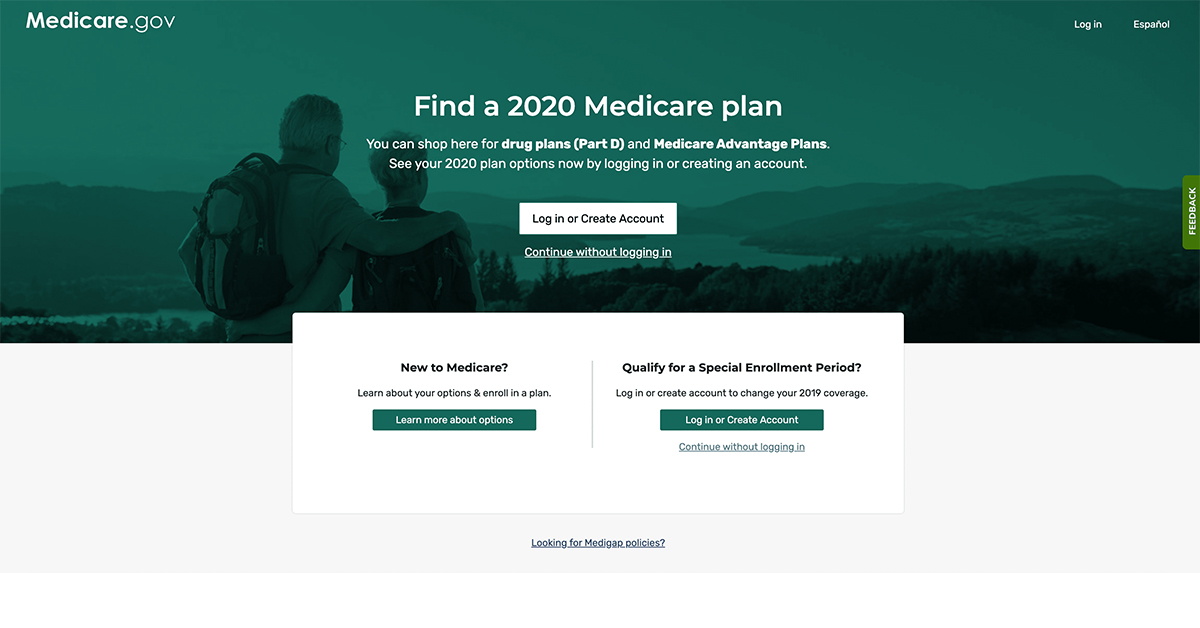

One convenient resource for Medicare-eligible individuals to research their coverage options is the Medicare plan finder tool available at medicare.gov. However, changes to Medicare plan finder rolled out in the past few months affect how the site indexes plans by cost and may lead users to accidentally enroll in a plan that is not the best fit for them.

Previously, the Medicare plan finder sorted plans by total cost as a default. Following last year’s changes, the site now sorts plans by premium, rather than overall cost.

These changes can result in Medicare eligible individuals inadvertently selecting plans with a higher overall cost.

The new site shows plans with the lowest premium first, listing the premium in large font. However, this format does not account for out of pocket costs such as deductibles and co-pays, which can make up a large proportion of overall healthcare costs. This is often especially so for the lowest premium plans, which typically make up for low premiums by imposing high out of pocket costs on insureds. If, like many Medicare eligible individuals, you take prescription drugs, out of pocket costs can dwarf monthly premiums as a component of overall healthcare costs.

The new system does include total annual cost, but this is displayed in a smaller font. Individuals using the plan finder should look for a drop-down menu found on the right side of the screen. From there, you can select an option to sort plans by “lowest drug + premium cost” in order to see results that more accurately reflect total cost.

The new system can be misleading for many users. So confusing, in fact, that Sen. Bob Casey of Pennsylvania, who serves on the Senate Aging Committee has proposed a special enrollment period for seniors who have been misled by the new system.

Changes to Medicare plan finder aren’t uniformly bad. The plan finder is now easier to use on tablets and mobile devices. It also allows users to compare Part D plans to Medicare Advantage plans with drug coverage.

Plans can vary widely in overall cost, especially for prescription drugs, because each insurer has its own coverage designs and formularies for covered drugs. Understanding these coverage designs and formularies is essential to obtaining the right coverage for you.

Luckily, expert help is available.